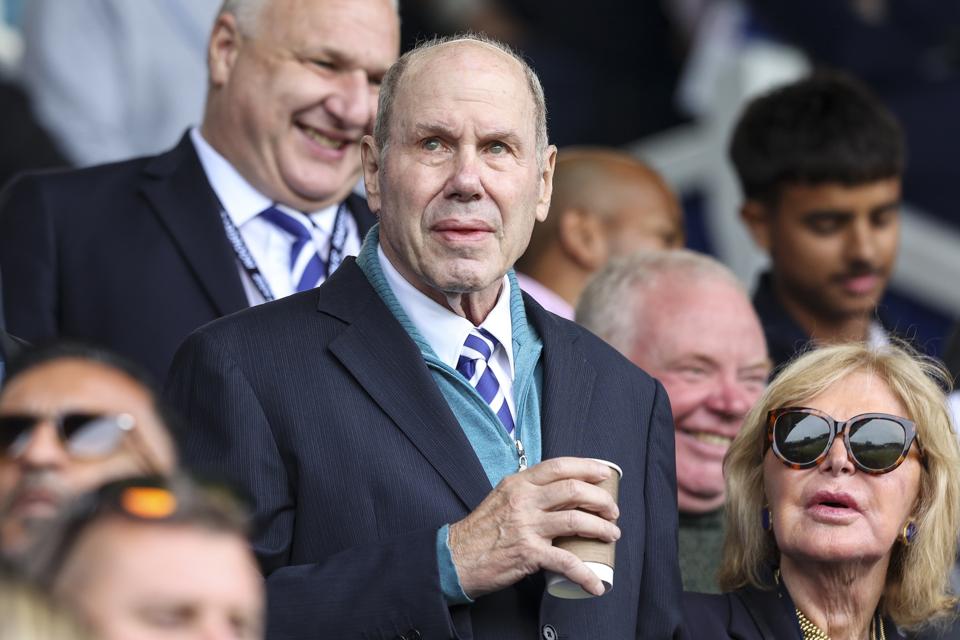

Michael Eisner may be synonymous with Disney, but he has kept himself busy since exiting the Mouse (Photo by Robin Jones/Getty Images)

Getty Images

Media companies don't come much more historic than Disney. The eponymous studio was founded by Walt Disney and his brother Roy 101 years ago and, to this day, only two other executives have been as synonymous with the company as they were.

Disney's current chief executive Bob Iger will forever be associated with the Mouse thanks to his acquisitions of Pixar, Marvel, Lucasfilm and 21st Century Fox. They turned Disney into a titan which consistently ranks as the highest-grossing studio in the movie industry. However, neither Iger nor even Walt himself laid the modern-day foundations that Disney is built on. Iger's predecessor Michael Eisner can take the credit for that and his track record at Disney really is the fairest of them all.

Few executives have cast as powerful a spell on the entertainment industry as Eisner. When he became Disney's chief executive on September 22, 1984 its stock price was just $1.24 and the studio was in the doldrums. However, by the time he handed over the hot seat to Iger 21 years later, each share was worth $23.80 and Disney was the world's biggest media company. Impressive as this is, it isn't the clearest evidence that Eisner really does have a magic touch.

The New York native joined Disney after an eight-year stint as chief executive of Paramount where he launched ground-breaking movies like Saturday Night Fever, Beverly Hills Cop and Raiders of the Lost Ark.

At the time, Disney was a shadow of what it is today. Construction costs at Walt Disney World in Orlando had spiralled and attempts to make more modern movies had led to forgettable live-action films such as sci-fi flop The Black Hole and Condorman, starring Michael Crawford. Combined with a failure to focus on new animation, repeated re-releases of its back catalogue and declining quality standards at its theme parks, Disney was at risk.

"They lost the company basically by overspending on Walt Disney World," explained Eisner in an interview with this author. "People don’t remember that but Walt, and particularly his brother, coming out of the Depression, were afraid of debt, so instead of using debt to build a pretty much over budget theme park in Florida, they used their equity. They sold. They lost control. They also way overspent and they didn’t have the attendance so between losing control, not having the attendance, not doing new animation, having very few live-action pictures, re-releasing the old library theatrically prior to home video, the company was at risk."

He added that "it was being torn apart. It could have been over in six weeks. When we walked down Main Street the second day in Disneyland I realised what a valuable asset it was." Eisner knew what was needed. "[George]

Lucas, Spielberg, us at Paramount, were making Disney-esque movies like Raiders of the Lost Ark and such," he explained. "Disney movies were being made but not by Disney."

With a wave of his magic wand, Eisner brought Disney back to its roots of hand-drawn animation yielding beloved favourites like Beauty and the Beast, Aladdin and The Lion King.

Eisner's Magic Formula For Reinvigorating Disney

"We concentrated on reinvigorating animation, particularly musical animation," he explained. "We obviously made an early deal with Lucas for Star Tours and Raiders of the Lost Ark because we had no recent movies for which to put in the parks. We then had a lot of recent movies, whether it was the Roger Rabbits, or the Aladdins, or Beauty and the Beast or The Lion King or whatever."

Eisner then commissioned rides based on them as well as merchandise to sell in the theme parks so the films acted as promotion for Disney’s resorts which in turn drove the sale of toys that would fuel kids’ interest in the movies. Eisner doubled down on this spellbinding cycle by building two new theme parks in Florida as well as others in California, Paris and Hong Kong. The 1990s were a golden era for the theme park industry and Disney was at the vanguard of it. So much so in fact that it was referred to as the Disney Decade.

Under Michael Eisner, Disney animation experienced a return to its glory days with movies such as 'The Lion King'

© Disney Enterprises, Inc. All Rights Reserved.

As Eisner explained, "we went to Europe. We went to Japan. We started negotiating in Hong Kong. We opened in Hong Kong. All that before I left." In turn, Hong Kong Disneyland paved the way for the opening of the Shanghai Disney Resort in 2016 which, until recently, was the studio's latest park. That only changed in May when it announced that one of its outposts is coming to Abu Dhabi's Yas Island after Iger signed a deal with Mohamed Al Zaabi, the trailblazing chief executive of Miral, the world's leading theme park operator outside Disney and Universal Studios.

The impact of Eisner's expansion was magnified by his emphasis on quality and details. He describes his legacy as "the strategy of excellence. The strategy of whatever you do, do it really well." It is no exaggeration. When Disneyland Paris (Euro Disney as it was then known) was being developed, Eisner amassed a team of the world's best designers to make it the most immersive theme park ever built.

They included Eddie Sotto, who meticulously created the park’s turn-of-the-century themed Main Street, and Tom Morris, the architect of its majestic castle. The clearest evidence they succeeded is the fact that the Disneyland Paris is still Europe’s most-visited theme park even though a new attraction hasn’t been built there for several decades. As this report revealed, launching Disneyland Paris may actually be the studio’s best-ever deal.

Eisner’s effect didn’t just extend to expansion. "We improved the food at Walt Disney World which was terrible in 1984. We built 30,000 hotel rooms, high-quality hotels, which they didn’t have - they had two." He added that “we did that in architecture. We built 80 buildings around the world at Disney. They had never done this before at Disney, they had always done it internally. We went with the best architects around the world.”

Eisner’s expansion helped Disney to become the world’s most-visited theme park operator with 142.1 million guests streaming through its turnstiles in 2023 according to the latest data from the Themed Entertainment Association. That's just the start.

In order to ensure that the studio didn’t get left behind by the rise of computer-animated movies, Eisner signed a pioneering deal in 1991 to distribute Pixar’s modern-day fairytales. Its films like Finding Nemo and Toy Story grossed a total of $3.4 billion during Eisner’s tenure paving the way for Disney’s $7.4 billion acquisition of Pixar in 2006.

Eisner also led the opening of Disneyland Paris in 1992 (Photo by Yves Forestier/Sygma via Getty Images)

Sygma via Getty Images

Ten years after he took over the top job at Disney, Eisner created a new category of entertainment when he gave the green light to a Broadway show based on Beauty and the Beast. It opened at the Palace Theatre in New York in 1994 and was such a success that it set the stage for other shows based on The Lion King, Aladdin, and Frozen. Since then, Disney Theatrical Group’s 10 titles have been seen by around 230 million theatergoers in 38 countries with The Lion King alone becoming the most successful show in theatre history playing to more than 115 million people in 100 cities.

Instead of resting on his laurels, Eisner pushed the boat out and in 1998 launched Disney Cruise Line which now generates more than $2 billion of annual revenue as I revealed in British newspaper City A.M.

Eisner declines to comment on the future of Disney and who should replace Iger. However, he is happy to look back and says that his turnaround of the company was driven by “new content, invigorated management, diverse management, which we didn't have when I got there, great assets that Walt created that you had to build upon. No one big thing to put the company at risk. Motion pictures that were less than the industry average. All of those things together were a result of what turned Disney around. Going to Broadway, which has been a giant success. And I think the businesses that we put together in those 21 years are still the businesses that Disney is [today].”

As the chart below and data here shows, by the time that Eisner stepped down on September 30, 2005, Disney’s stock price was $23.80 which was a staggering 19.2 times higher than when he joined the company. It comfortably makes him the most successful boss in Disney's history as its stock price only rose 5.4 times during Iger's initial term which ran until February 25, 2020 when each share was worth $128.19. Former theme parks chief Bob Chapek took over the driving seat and although the stock price hit an all-time high of $201.91 under him, by the time he handed the reins back to Iger on November 20, 2022, it had slumped to just $97.58 which was lower than when he became Disney's boss.

Disney's share price since 1984

Caroline Reid using Flourish

Life After The Mouse

When Eisner stepped down he could have retired thanks to his sizeable pile of Disney stock which has soared even higher in value under Iger, closing at $119.35 today. Instead, he built up a boutique media company called Tornante after seeing signs showing the word on a cycling trip through Italy. Meaning 'hairpin turn’, the name was fitting as Tornante headed in a completely different direction to Disney by producing hit adult animation series on Netflix such as Bojack Horseman and Tuca and Bertie.

Despite his close ties to streaming, Eisner is still a big believer in movie theaters as this reporter revealed in the Daily Mail in 2023. He has also recently written a book called Camp, about the lessons he learned at summer camp, and has diversified outside media. Tornante has made investments in prize-draw company Omaze and trading card business Topps, which was sold to Fanatics in 2022 for an estimated $500 million. However, they were just trailers for the main event.

Soon after Eisner turned 75 in 2017 he took perhaps his biggest swing yet when he acquired British soccer club Portsmouth FC. The team was founded in 1898 and was experiencing one of the toughest times in its history. In 2012 the historic team had fallen two tiers below the top flight Premier League after collapsing into administration – the British equivalent of Chapter 11 bankruptcy – for the second time in two years. Its plight was so serious that it had to be rescued by its fans before its real life prince charming came along.

Eisner bought English soccer club Portsmouth FC in 2017 (Photo by Paul Harding/PA Images via Getty Images)

PA Images via Getty Images

Eisner had some experience in sports as under his leadership Disney bought the Los Angeles Angels baseball team and founded the Anaheim Ducks NHL squad which went on to win the World Series and the Stanley Cup respectively. Accordingly, making a success of a soccer team may sound like a cinch, especially for someone who built up the world’s biggest media company. However, Eisner wasn't willing to buy his way to the top and burn up blockbuster losses. There is good reason for this.

The First Mover

Eisner was one of the first of a string of American celebrities to invest in British soccer teams. He was followed by Ryan Reynolds, Michael B Jordan and Will Ferrell who invested in Wrexham FC, AFC Bournemouth and Leeds United respectively. Eisner wasn’t jumping on a bandwagon and instead bought Portmouth FC, or Pompey as it is affectionately known, because he is a devoted soccer fan himself. He even invited Ferrell to matches leading to his investment in Leeds.

Eisner’s goal is getting Portsmouth back into the prestigious Premier League by building it up organically. What's more, he wanted it to be the springboard for a behind the scenes show along the lines of the hit Ryan Reynolds Disney+ docuseries Welcome to Wrexham.

Eisner revealed the rationale behind it in a 2019 interview with this author for the Daily Mail at his office in Beverly Hills. When asked why a media boss would want to own a soccer team he replied “football is the most direct [investment of my] media strategy. It is the most obvious and the clearest as opposed to the least obvious.”

He explained that “content, in my opinion, is still the essential ingredient in the media and having content is still the most important thing in media...Any platform that is appealing to an audience has to have something that lights up the Christmas Tree. And what lights up the Sky Christmas Tree or the ESPN Christmas Tree is live sports.”

Known as appointment viewing because fans have to tune in at a specific time to watch it live, sport commands premium prices by broadcasters. "The only thing that demands viewing when it happens is sports. Yes, you have replays and you have all sorts of analysis of sports but if you know the score at the end of the game, the rest is really just icing on the cake."

Eisner sees great value in sports programming such as Ryan Reynolds and Rob McElhenney's 'Welcome to Wrexham' (Photo by Leon Bennett/The Hollywood Reporter via Getty Images)

The Hollywood Reporter via Getty Images

The drama of live sport also yields immensely passionate fans who crave content about their heroes. It explains why Welcome to Wrexham has been so popular but it wasn't the first mover in the streaming space. That accolade goes to Sunderland Til I Die, a 2018 Netflix series about the disputes and dilemmas behind the scenes at Sunderland AFC which had just been relegated from the English Football League Championship to League One.

As Eisner explained, "all you have to do is watch Sunderland Til I Die on Netflix to understand the emotion of a team going into dissent." In fact, it was this show that convinced the actor Rob McElhenney to buy a soccer team leading to his investment in Wrexham with Reynolds. At the end of last season Wrexham was promoted to the Championship, one step below the Premier League.

The odds seemed stacked against Eisner getting Portsmouth back to the top as English soccer is full of team owners who are prepared to pour billions into their squads in a bid to win on the pitch and earn international acclaim. However, afer seven calendar years in charge, his happy ending is within striking distance.

Portsmouth won the League One title in the 2023-2024 season and was promoted to the Championship after a 12-year absence. Since then, the team has retained its place there and will make a renewed charge for promotion to the Premier League when the upcoming season gets underway on Friday. Perhaps indicating Eisner’s confidence in its chances, he recently announced that Portsmouth is planning to film behind-the-scenes content over the coming year.

Eisner’s Real Goal

It is a momentous milestone as it will give him the content he envisaged back in 2019. Most impressively, Eisner has managed to get this far without burning up blockbuster losses and putting the team in jeopardy. Quite the opposite actually as analysis of its latest financial statements reveals that the team now has the strongest capital structure in its 127-year history with no debt and net assets of $33.5 million (£26.5 million) as of June 30, 2024.

Its net asset value has increased more than five fold since the supporters took over the club in 2013 which shows how strong the business has become. The metric is calculated by deducting a company’s liabilities from the value of its assets so the higher the value, the lower the level of risk. The net result can be a sign of impending peril and, testimony to this, Portsmouth had net liabilities of $93.8 million (£47.5 million) in 2008 before it collapsed less than two years later.

Since Eisner bought the team its cash reserves have risen 16.3% to $3.9 million (£3.1 million) which also gives strong confidence in the business. Its success has been shared amongst its staff as their pay has almost doubled to $13.4 million (£10.6 million) since Eisner took control even though employee numbers have decreased by 26.1% to 275.

Staff and players were paid bonuses after the team was promoted and this partly fueled a $7.1 million (£5.6 million) net loss last year which pales in comparison to the red ink burned up by its counterparts in the Premier League. Everton FC for example reported a $67.3 million (£53.2 million) net loss last year whilst Tottenham Hotspur lost $33.1 million (£26.2 million).

Both clubs have hundreds of millions of dollars of revenue as they share in the proceeds of the league’s broadcast deals which are amongst the biggest in world soccer. It explains why Portsmouth's revenue is far lower though it rose 8.9% last year to $17.2 million (£13.6 million), the highest level since Eisner bought the team.

Portsmouth FC's key financial data

Caroline Reid using Flourish

Last year alone, matchday takings increased 6.3% to $8.7 million (£6.9 million) whilst broadcasting revenue rose by almost double that percentage to $3.2 million (£2.5 million). The increased broadcast exposure gave a 21.4% boost to the team’s commercial and sponsorship revenue with partners including Nike and Uber Eats paying a total of $2.3 million (£1.8 million) in 2024.

It was a family effort as the team is run by Eisner’s dynamic entrepreneur sons Anders, founder of zero-sugar brand Activate Drinks, producer Eric and director Breck who made 2005 adventure film Sahara starring Matthew McConaughey and Penélope Cruz. They are accompanied by talented managers including chief executive Andrew Cullen, chief marketing officer Matthew Barker, chief commercial officer Mark Judges and the coach John Mousinho.

Although Eisner’s spending on Portsmouth hasn't been unchained, he hasn't left the club wanting. Its 2018 financial statements revealed that "the purchase of the club by Tornante resulted in an injection of £10 million [$13.2 million] new working capital which bolstered the balance sheet to a new positive total of £12.6 million [$16.6 million] net assets." It didn't stop there.

As of June last year the Eisner family had invested $46.8 million (£37 million) in the club including $24 million (£19 million) alone on the redevelopment of its Fratton Park stadium. This began in June 2021, well ahead of the club's 125th anniversary, and was handled by Robert Stern who Eisner knew through his work at Disney.

Eisner has invested $24 million in the redevelopment of Portsmouth's Fratton Park stadium (Photo by Ben Hoskins/Getty Images)

Getty Images

Stern designed Disney's Feature Animation Building in Burbank, California, with its soaring blue replica of Mickey Mouse's pointy sorcerer's hat. Stern was also behind Walt Disney World's lavish Yacht and Beach Club Resorts, which look like sprawling New England mansions, and their counterpart at Disneyland Paris, the Newport Bay Club.

His work on Fratton Park had a magic touch as average attendance increased by around 1,000 to 18,952 in the year to June 30, 2024 and on February 17 last year Portsmouth had its first crowd of more than 20,000 spectators in 13 years. Its latest financial statements add that "in the second half of the season, we capped our season tickets to 15,000 and introduced a season ticket waiting list at Fratton Park for the first time in many years."

In turn, the surge in spectators led to record hospitality kiosk and merchandising sales which is perhaps as significant a home run as the team's success on the pitch. "It is a game about winning. It is a game about progressing upwards. It is a game about strategy. It is a game about intelligent management," says Eisner. "Just like in the entertainment business."

.png)

English (US) ·

English (US) ·